Budget predictions from vaping tax to National Insurance - what it means for you

Tory Chancellor Jeremy Hunt will today deliver what could be his final Budget before the general election.

He is under intense pressure from Tory MPs to slash taxes but also faces calls to spell out what it would mean for public spending amid fears of another round of savage austerity cuts.

It comes after Rishi Sunak's boast that the economy had "turned a corner" was left in tatters a fortnight ago with official figures showing Britain had plunged into recession.

The Chancellor will deliver his Budget - outlining the Government's tax and spending plans - shortly after Prime Minister's Questions, at around 12.30pm. Here The Mirror looks at what the Chancellor could announce - and how it affects you.

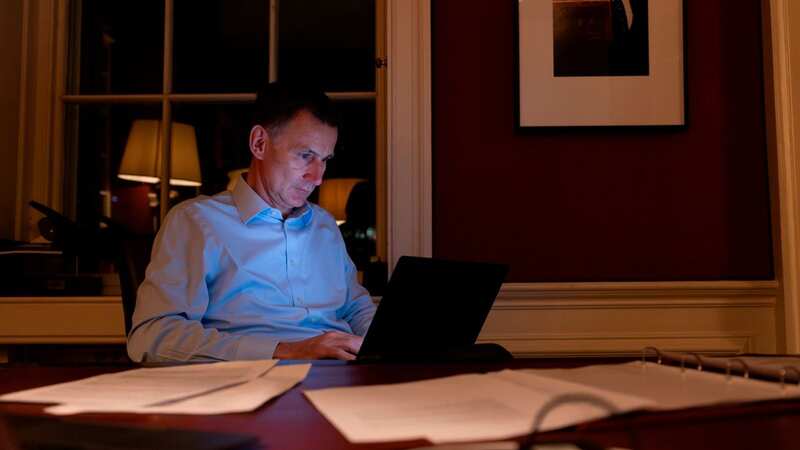

The Chancellor is under immense pressure from Tory MPs to cut taxes (Getty Images)

The Chancellor is under immense pressure from Tory MPs to cut taxes (Getty Images)Income Tax or National Insurance cut

In his pre-election Budget Jeremy Hunt is said to be mulling a cut to either National Insurance or Income Tax.

Couple living on cruise ship as it makes 'more sense' than paying mortgage

Couple living on cruise ship as it makes 'more sense' than paying mortgage

Under intense pressure from Tory MPs to slash taxes before the country heads to the ballot box, the Chancellor has been weighing up his options. According to The Times a further 1% - or 2% - cut in employees National Insurance could be unveiled with a £4.5billion a year price tag. It follows a 2% cut at the Autumn Statement last year. According to the New Economics Foundation a 1p cut in National Insurance would benefit the richest households by 12 times more than the poorest.

But even if the Chancellor goes ahead with this change, taxes are on course to reach record levels due to Tory stealth taxes. Income tax thresholds, which usually rise in line with inflation, were frozen by Mr Sunak as Chancellor in 2022 until 2028.

He has also been warned by the Institute for Fiscal Studies think-tank against announcing cuts unless he can show how he will pay for them. Current post-election spending plans already mean further cuts to unprotected public services.

If you can't see the poll, click here

Vape tax

Rishi Sunak’s crackdown on vaping continues as the PM and his Chancellor consider a new tax. Currently vaping liquid is subject to VAT but an announcement at the Budget could see a separate levy imposed.

The Mirror first revealed back in December that ministers were looking to copy other European countries including Germany and Italy that already have levies on vapes.

A 10ml bottle of e-liquid, which a typical vaper would get through in a week, costs around £4 at present. But in Germany a £1.40 vape tax is slapped on 10ml bottles and there are plans to double this to £2.80 in 2026. Reports have also suggested the new levy could see higher levels of tax for products with more nicotine.

Tobacco duty

If a new vape tax is introduced the products will remain a cheaper alternative to tobacco. At the Autumn Statement in November the Chancellor announced all tobacco products would increase by 2% above inflation.

There was also a massive additional hike of 10% on hand-rolling fags. In a further blow to smokers’ pockets Mr Hunt could impose another one-of increase in tobacco duty at the Budget. There have been reports a pack of 20 cigarettes could cost on average around £16 after the Budget.

99% mortgages scheme for first time buyers

The Chancellor is said to be considering a plan to allow first-time buyers to take out mortgages with a 1% deposit to help young people on the property ladder. Currently the mortgage guarantee scheme allows first-time buyers to take out a mortgage with a 5% deposit until June 2025.

Families face £13,000 mortgage hike after Tory 'mismanagement' - find your area

Families face £13,000 mortgage hike after Tory 'mismanagement' - find your area

But if Mr Hunt introduces “99% mortgages” as widely reported it would mean someone buying a house at the average UK price of £288,000 would need to put down a deposit of £2,800 - rather than £14,400.

But experts have warned 1% deposits could be a “short-term” fix as it does not address chronic housing shortages and could push up prices even further. Annual figures published in November showed the Tories had failed to meet their manifesto pledge to build 300,000 news homes a year.

Stamp duty cuts

It remains to be seen whether the Chancellor tweaks the stamp duty regime. Under the current system the amount a person pays depends on the value of the property - or whether they are a first time buyer.

In England and Northern Ireland, no stamp duty is paid if the property is worth under £250,000. If the property is worth more than this, you pay 5% in stamp duty on the amount worth between £250,0001 and £925,000, then 10% between £925,001 and £1,500,000 and 12% above £1,500,000. First-time buyers only pay stamp duty if the property is worth over £425,000.

Last month the former Tory housing minister Robert Jenrick urged the Treasury to “cut stamp duty by increasing the thresholds, lowering rates or scrapping it altogether if the headroom allows”.

The Institute for Fiscal Studies has suggested stamp duties “are particularly damaging taxes and should be at the front of the queue for growth-friendly tax cuts”.

Fuel duty freeze

Fuel duty on both petrol and diesel has stood at 52.95p-a-litre since 2011. Mr Hunt would not be drawn on a further freeze when he appeared in front of MPs at the end of last year, simply saying “you’ll have to wait until the spring Budget”.

But the Chancellor will almost certainly extend the freeze - for the 14th year in a row - as he unveils the Budget.

The 5p-a-litre cut in fuel duty, which was announced in 2022 in response to a spike in global prices, could also be extended for another year.

Inheritance tax

A cut to inheritance tax for some of the country’s wealthiest families has long been considered by the Treasury. But it now appears more likely to appear in the Tories’ general election manifesto than the Budget today.

The levy was paid by just just 4% of estates in the UK in 2021 and the vast majority of people will never pay it. Abolishing the measure completely could come with a hefty price tag of at least £7billion-a-year.

The One Nation caucus of Tory MPs has urged the Chancellor against “prioritising tax cuts that only benefit the most wealthy, such as the Inheritance Tax”. Instead, they have urged the Chancellor to abolish stamp duty for buyers thinking of downsizing.

Household Support Fund

Help for struggling low-income households under the Household Support Fund was first introduced back in 2021. It provides extra money to councils to help those most in need with essential food and energy costs.

Last year the Treasury announced a 12-month extension to the scheme - worth over £800million - but a decision on its future beyond March 31 has not been announced.

MPs and Mayors across the country have urged the Chancellor to once again extend the “vital lifeline” for the most vulnerable families. They said the fund had been used to boost food bank supplies, support those fleeing domestic violence, and food vouchers for at-risk young people. The Chancellor will have a massive row on his hands if ends the scheme on Wednesday.

Child benefit

There had been speculation the Chancellor would use the Budget to extend child benefit to thousands of middle-income families, with the Treasury extending the threshold at which the benefit is gradually clawed back.

Since 2013 it has been frozen at £50,000 while those earning over £60,000 lose the benefit altogether. But there have been warnings it unfairly penalises single parent families.

This is because a couple can have a combined income of up to £100,000 and not be affected - so long as neither of their salaries are above £50,000. Money Saving Expert Martin Lewis has said it would be a "very popular measure if it were addressed in the Budget". But the i newspaper reported Mr Hunt has decided against any major tweaks to the system because of the bleak economic situation.

Tax perks for holiday lets

Holiday let owners could lose a tax perk as the Chancellor considers plans to raise another £300million at the Budget. Mr Hunt is looking at abolishing perks that allow landlords to rent out their properties to holidaymakers rather than long-term tenants, according to the Times.

Generation Rent, which has been campaigning for the measure, say in Britain's holiday hotspots first-time buyers "have been getting outbid not by landlords but holiday let operators, while tenants have lost out to tourists". But the National Residential Landlords Association said: “The Chancellor needs to address the chronic shortage of long-term rentals by attracting new landlords to the market. Squeezing holiday lets is not the answer."

Non-dom tax loophole

Jeremy Hunt is considering scrapping or scaling back the "non-dom" tax loophole for super-rich UK residents in a major U-turn. The Chancellor is looking at the option as he desperately searches for extra cash to fund general tax cuts at his pre-election Budget.

The loophole allows around 70,000 UK residents whose permanent home, or domicile, is outside of Britain, to avoid paying UK tax on overseas income and potentially save millions. Labour pledged to abolish the measure two years ago after it was revealed Rishi Sunak's non-dom wife Akshata Murty could have saved millions.

Read more similar news:

Comments:

comments powered by Disqus