Be Club misleads consumers on regulatory fraud warnings

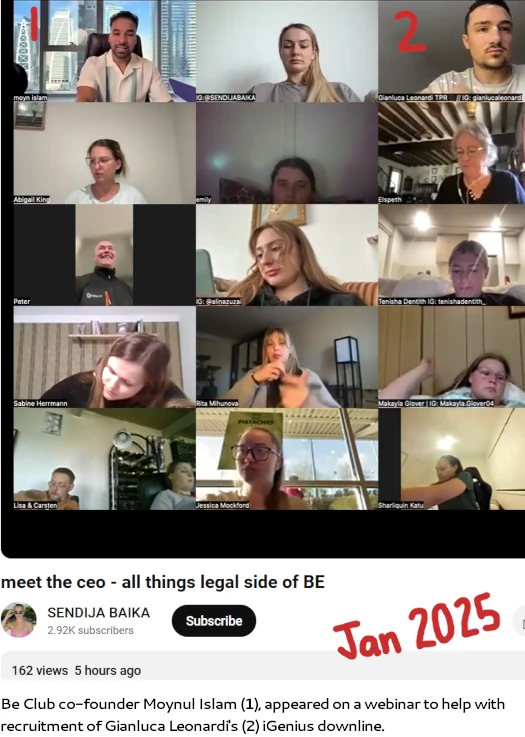

A few days ago a reader wrote to the editors of BehindMLM and talked about a Be Club webinar featuring co-founder Moynul Islam (better known as Moyn).

The call, hosted by former iGenius promoter Gianluca Leonardi, appears to be part of an attempt to recruit Leonardi’s iGenius downline into Be Club.

Be Club desperately needs an injection of new suckers. For December 2024 SimilarWeb tracked just ~3100 monthly visits to Be Club’s website.

88% of the traffic originated from Italy, which just happens to be where Gianluca Leonardi is from.

Now that you know the context of the webinar, we can move onto the webinar itself.

Evidently a large part of convincing Leonardi’s iGenius downline to migrate over to Be Club is to address it’s multiple regulatory fraud warnings.

Before we get into Islam’s deception on that though, it’s worth noting that said deception begins right from the beginning.

In the webinar Moyn, rather than be honest about joining OneCoin, stealing a bunch of money and then fleeing to Dubai, spins a story about joining ACN, not making much money, fast-forward to 2018 and Moyn and his brothers launch their own MLM company.

After setting himself up, Moyn gets into Be Club’s regulatory warnings. To smooth over Be Club’s regulatory warnings, which pertains to Be Club’s fraudulent business model, Moyn trots out a “everybody gets regulatory fraud warnings” ruse.

First off “everybody is doing fraud, we’re not the only ones!”, is not a confidence-inspiring excuse.

Putting that aside for the bigger picture, the immediate disconnect between Moyn’s assertion and reality is none of Be Club’s regulatory fraud warnings pertain to “forex and trading education”.

Be Club started off as Melius. Launched in 2018, Melius saw the Islam brothers hide behind CEO Jeremy Prasetyo. Melius’ business model combined commodities fraud with pyramid recruitment.

Melius collapsed in 2020 and was rebooted as Better Experience, better known as just “Be”.

Be initially dropped Meliu’s commodities fraud but retained its pyramid scheme. In mid 2024 Be rebooted as Be Club.

Through its “SageMaster”, Be Club saw a return to commodities fraud with added securities fraud. To the best of my knowledge the SageMaster investment scheme remains the current iteration of Be Club.

On the regulatory front:

Colombia issued a Be Rules securities fraud warning in February 2022

Norway issued a Be investment fraud warning in March 2023

Uruguay issued a Be pyramid fraud warning in April 2023

the Philippines issued a Be securities and Ponzi fraud warning in November 2023

New Zealand issued a Be Club securities fraud warning in October 2024

None of these regulatory fraud warnings were challenged and all remain in force and effective as at time of publication.

…but you wouldn’t know that to listening to Moyn.

As per the very much still active and enforced regulatory fraud warnings above, Moyn’s statement is a flat out lie. You can verify this yourself by seeing the warnings on the respective regulator’s websites and contacting them if you need to.

Again, refer to the multiple in effect Be and Be Club regulatory fraud warnings cited above.

Moyn goes on to trot out a PDF documented dated January 7th, 2025.

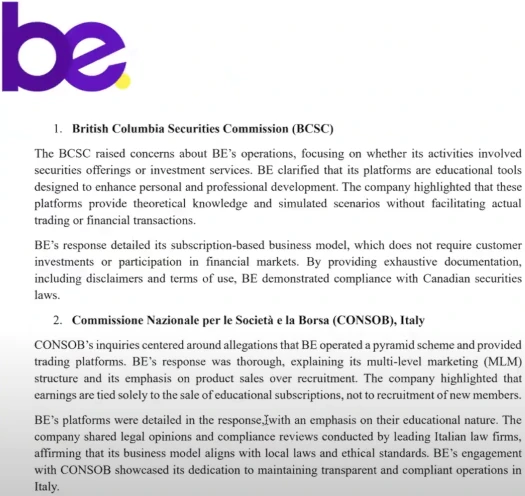

Note that the document cites communication with the British Columbia Securities Commission, Italy’s CONSOB, Belgium’s FSMA and Quebec’s AMF. To the best of my knowledge these regulators have not issued public warnings pertaining to Melius, Be or Be Club.

That doesn’t mean pyramid, securities and commodities fraud is legal in these jurisdiction, only that I can’t speak specifically to any action taken.

Outside of these two jurisdictions, Moyn’s “regulators” document can be boiled down to:

a regulator flagged Be or Be Club as a fraudulent scheme

Be hired some local lawyers

local lawyers allegedly sent a few emails to the regulator

see, we did something

This isn’t how regulation works.

When a regulator issued a fraud warning the company cited typically has a window to officially respond and challenge the underlying investigation.

If an MLM company is successful at presenting its case at a hearing or hearings, the public fraud warning is withdrawn.

Contrary to Moyn’s claims, this has not happened in any jurisdiction in which a regulator has issued a public Be or Be Club fraud warning.

Moyn goes on to claim Be’s and Be Club’s fraud warnings come down regulators “not understanding what we do”. This is classic scammer copium.

With respect to running a pyramid scheme, you either have more retail customers than affiliate promoters by sales volume or you don’t.

With respect to securities and commodities fraud, either you are registered with financial regulators or you aren’t. Neither Melius, Be, Be Club or Moyn and his brothers have registered with financial regulators.

Moyn further rests his laurels on there being “no further action” taken after regulatory fraud warnings were issued.

This primarily comes down to Be and Be Club completely collapsing in each jurisdiction a regulatory fraud warning was issued in. To a lesser extent it also comes down to the Islam brothers fleeing the UK for Dubai as OneCoin was collapsing.

Dubai is the MLM crime capital of the world. Local regulation of MLM related pyramid, securities and commodities fraud is non-existent.

Perhaps not surprisingly, Gianluca Leonardi has also relocated to Dubai.

Accompanying Moyn Islam appearing on Gianluca Leonardi’s webinar are a series of documents with more falsehoods.

First we have “Be Club: A Legally Complaint and Ethical Direct Sales Leader in the UK and Globally”.

In this document Be holds up its shell company registrations as somehow translating to legal compliance. Shell companies don’t mean anything with respect to regulation and legal compliance.

Actual legal compliance would see Be registering with financial regulators, which it has not.

Be also holds up its UAE MLM association memberships. Again, Dubai is the crime capital of the world. These registrations mean nothing as far as legal compliance goes.

And finally we have this nonsense;

The company has undergone legal scrutiny in highly regulated markets such as the USA and Italy, where it was found to be legitimate and compliant with all laws.

BE CLUB has proactively subjected itself to scrutiny in jurisdictions with stringent regulatory requirements:

USA: Known for its rigorous enforcement of consumer protection laws.

Italy: A market with strict regulations on direct selling and multi-level marketing companies.

In both cases, BE CLUB was found to be a legitimate business, operating in full compliance with the law, and it continues to thrive without any fines or penalties.

Be Club is correct in the US being known for rigorous enforcement. It’s why Be Club has never taken off in the US.

Instead, by its own admission, Be Club targets “developing countries”.

Also regulators don’t rubber-stamp companies. Asserting legal compliance because a country’s regulators haven’t issued fraud warnings is false equivalence.

Specific to the US you can verify Be Club isn’t registered with the SEC or CFTC by respectively searching the EDGAR and NFA databases.

If it were active in the US, Be Club committing securities and commodities fraud in violation of US financial law is verifiable proof it isn’t legally compliant there.

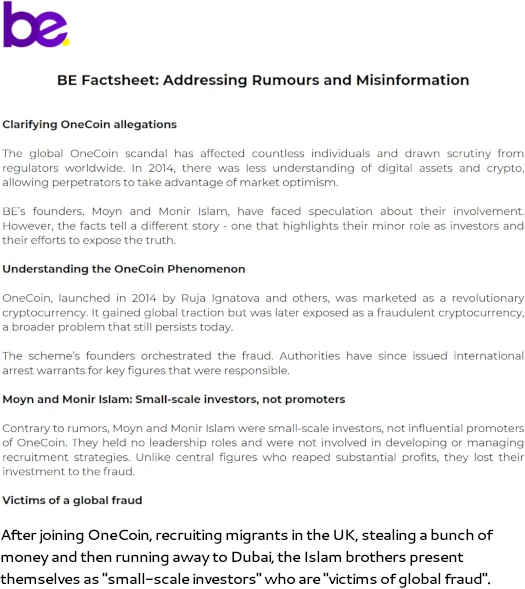

Next we have “Be Factsheet: Addressing Rumours and Misinformation”.

This document attempts to downplay the Islam brothers role as OneCoin Ponzi promoters.

BE’s founders, Moyn and Monir Islam, have faced speculation about their involvement.

However, the facts tell a different story – one that highlights their minor role as investors and their efforts to expose the truth.

The truth is the Islam brothers were top OneCoin promoters in the UK. They primarily targeted migrant communities and, after stealing a bunch of money from these communities, the Islam brothers dipped and fled to Dubai.

That’s history, that’s what happened. That the Islam brothers can’t even acknowledge these basic truths (that anyone can independently verify, it’s not like the Islam brothers promoted OneCoin in secret), speaks to their characters.

Right now Be Club is on death’s door and has been for most of 2024. Should Gianluca Leonardi successfully plunder his iGenius downline and recruit them into Be Club – triggering a boost in local recruitment, I suspect it won’t be long before we see a CONSOB Be Club fraud warning.

Failing which pyramid recruitment, securities fraud and commodities fraud are all illegal in Italy in any case.

If you’re in Gianluca Leonardi’s iGenius downline and are thinking of signing up with Be Club, ask yourself why nobody from prior countries Be Club has had a run in are still around. Why is it outside of Leonardi’s recent focus on his Italian iGenius downline is there nothing going on in Be Club?

You can verify yourself that Be Club and the Islam brothers aren’t registered with CONSOB. As far as actual due-diligence goes, unless you’re comfortable with fraud that should be the end of it.