Holton Buggs contests Traders Domain injunction in ongoing legal battle

Disgraced MLM veteran Holton Buggs is shamelessly challenging the CFTC’s request for a Traders Domain preliminary injunction.

Buggs, who is alleged to have misappropriated millions of dollars through Traders Domain, is the only defendant challenging proceedings.

As per the CFTC, Buggs personally recruited “at least 517” investors, who together invested “no less than $54 million” into The Traders Domain.

Buggs recruited customers through his existing multi-level-marketing (“MLM”) businesses, in person events that he attended throughout the United States, including in Miami, Florida and San Diego, California, and by soliciting individuals with whom he had previous business dealings, including a Buggs customer in Sarasota, Florida.

Buggs also fraudulently misappropriated funds, by accepting some customer funds into bank accounts that he controlled and using those funds to pay for personal expenditures, including a Lamborghini and a condominium in Florida.

Additionally, Buggs misappropriated customer funds by taking commissions of 40-50% of purported profits on trading that he knew or should have known was fabricated.

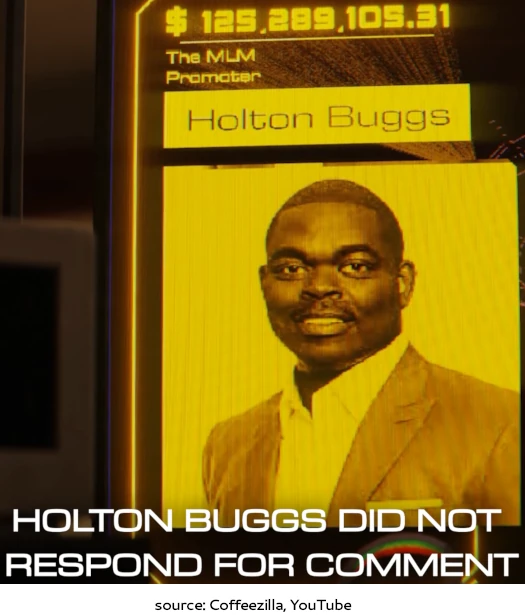

A leaked database shows Buggs’ The Traders Domain balance as of June 2022 was over $125 million.

A December 2nd Initial Status Report from The Traders Domain Receiver details dealing with Buggs thus far.

To date, Defendant Buggs has not asserted the Fifth Amendment privilege with respect to his obligations under the SRO, but has refused to provide any information to the Receiver, other than allowing the Receiver to inspect one of his houses in Houston, Texas.

The Receiver attempted to take an asset deposition of Defendant Buggs on November 14, 2024, but neither Buggs nor his counsel appeared.

The Receiver is attempting to once again take an asset deposition of Buggs on December 4, 2024.

It’s unclear but unlikely that Buggs turned up for the second scheduled asset deposition either.

On November 7, 2024, the Receiver’s attorneys inspected one of the houses owned by Defendant Buggs located at 3102 Noble Lakes, Houston, Texas 77082.

The Receiver’s attorneys were accompanied by Defendant Buggs and his counsel.

The house contained expensive furniture; designer clothes, purses, and shoes; a large fish tank and bowling alley.

The Receiver’s attorneys took photographs and video of the house. According to the Receiver’s investigation, and without verification or assistance from Defendant Buggs or his counsel, the Receiver believes Buggs also owns houses at [address withheld] Houston, Texas 77082 and [address withheld], Houston, Texas 77077.

While at the Noble Lakes property in Houston, the Receiver’s attorneys observed a 2021 Rolls Royce that according to the Texas Department of Motor Vehicles had a sales price of $639,000; and a 2020 Tesla that according to the Texas Department of Motor Vehicles had a sales price of $124,770.

Buggs not cooperating with authorities is nothing new. As per the CFTC;

On July 20, 2023, the Commission sent Buggs an investigatory subpoena for his communications, financial records, and accounts related to Traders Domain.

In response, Buggs, through counsel, asserted his 5th Amendment right against self-incrimination and refused to produce the majority of the requested items.

The CFTC is concerned Buggs is already actively liquidating assets, in potential violation of a granted Statutory Restraining Order (SRO).

It appears that the Commission’s concern about asset dissipation by Buggs was well-founded. During a November 1, 2024, telephone conversation with counsel for the Receiver … counsel for Defendant disclosed that Buggs had recently sold a Rolls Royce.

Because Buggs continues to delay providing discovery regarding assets to the Receiver, the CFTC does not know whether the sale occurred in violation of the SRO or prior to its implementation or what Buggs did with the proceeds of the sale, only heightening the concerns about asset dissipation.

Last month Buggs filed an motion seeking dissolvement of the The Traders Domain Receiver and granted SRO. The CFTC filed its opposition response on December 6th.

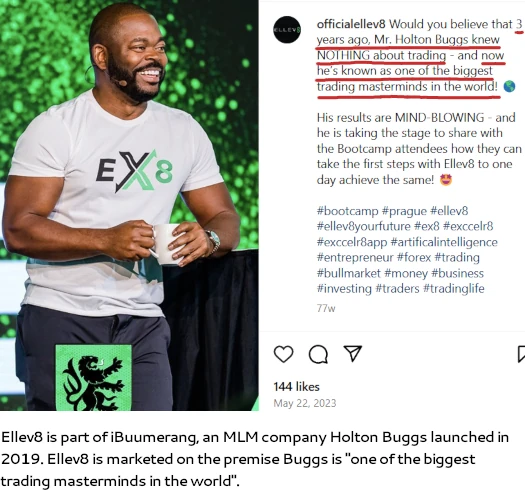

BehindMLM previously covered Buggs’ arguments against the granted SRO. The stand-out argument was Buggs pretending to be clueless about trading.

I have no formal education, experience, or training in commodity trading, securities trading, or any related financial field.

As such, in making investments, I have sought opportunities through reputable channels and have relied on professionals in my network for investment-related advice and introductions.

Ellev8, part of Buggs’ iBuumerang MLM company, is marketed on the premise Buggs is “known as one of the biggest trading masterminds in the world”.

The CFTC further pulls apart Buggs’ “I knew nothing!” defense;

The Complaint identifies misrepresentations by Buggs that he unquestionably knew were false at the time he made them, and others that he even admitted were false to his customers.

In addition, it details how Buggs:

(i) was warned by a former employee and a business associated that TD was manipulating and/or fabricating trades and was not licensed or registered,

(ii) knew that TD wanted to disguise the purpose and origin of customer deposits, and

(iii) he was warned numerous times and made aware of public complaints that TD was engaged in fraudulent conduct.

Buggs attempts to frame his role as a “passive participant” who merely “shared information about my experience with TD with a close circle of family and friends.” But Buggs “close circle of family and friends” was actually at least 517 customers who deposited no less than $54 million at Buggs’ direction.

And although Buggs claims to have “shared [his] experience with TD informally,” he charged his TD customers commissions as high as 50% of purported profits for his “informal” role, through which Buggs, and his family, gained millions of dollars as a result.

Emphasizing Buggs’ shamelessness in light of the overwhelming presented evidence, eleven The Traders Domain defendants have already consented to a preliminary injunction.

A preliminary injunction hearing for Buggs and five remaining defendants has been scheduled for January 6th, 2025.

Finally, the Receiver’s Initial Status Report also details plans for net-winner clawback recovery.

The Receiver is investigating the false profits paid to investors and appropriate next steps to recover same.

To date, the Receiver has recovered $332,081.16 from financial institutions. A number of properties owned by the The Traders Domain defendants are also frozen as per the SRO.

While BehindMLM will continue to cover The Traders Domain proceedings, we remind readers we are not a support platform for victims of the scheme.

The Traders Domain victims are directed to the The Traders Domain Receivership website.

Source: behindmlm.com

Read more similar news:

Comments:

comments powered by Disqus