Venezuelan involvement in BES/Venezuela case revealed: father and son Rafael Cure play key roles

The investigation by the Portuguese prosecutor’s office into the so-called BES / Venezuela case concluded last year and produced only some accusations against former directors of the bank that collapsed in 2014. Even so, its file tells the details of the participation of Venezuelans in the corrupt plot, some as bribed, and others as loan sharks or facilitators for the flow of money. In both categories, two citizens named Rafael Cure, father and son, until now unknown to the public, appear with important roles.

It is not yet known on what date the trial of the so-called BES / Venezuela case will begin , in which the Portuguese justice system is preparing to assess the alleged crimes committed by the senior management of the financial group of Banco Espirito Santo (BES), intervened in 2014 and liquidated dessert, would have committed with the payment of bribes and commissions to officials of Hugo Chávez’s government in Venezuela. It is known in advance, however, that seven executives of the conglomerate will be on the bench, including Ricardo Salgado, its last president.

All of the accused were part of the management staff of the financial group itself or of Gestar-ICG, the wealth management company that was created ad hoc to channel the flow of irregular payments to public officials in Venezuela and others. It took the Portuguese prosecutor’s office nine years to complete the investigation of the case, which led to a statement of charges in October 2023.

However, in the almost 900 pages of the accusation, which are added to the 19,000 of the investigation, the file that the Portuguese public ministry built - and to which the Lisbon newspaper Expresso had access and shared with Armando.info - relates the participation of dozens of Venezuelan citizens in the scheme. The prosecution finally refrained from charging them, either because they lacked compelling evidence that could eventually convince the court, or because they considered that their possible infractions occurred outside of Portuguese jurisdiction.

In this wide cast of Venezuelan characters, there are usual suspects of misdeeds with public affairs, such as Rafael Ramírez Carreño, Nervis Villalobos or Rafael Reiter, officials who received payments from the BES to send very large funds of state money to their vaults that prolonged lives. from the troubled bank for five years.

But there is also a second-rate chorus made up of people who lent their names or their accounts and companies, as well as other types of assistance, to articulate the payment route and camouflage their beneficiaries.

Among those Venezuelan citizens who flew close to the shadows at the service of this payment network was, for example, Rafael Cure López, a practically anonymous former employee of the state oil company PDVSA, a company that was the bank’s main client in its dying years.

“Everyone was perfectly aware of the position that Rafael Cure López held in PDVSA and the illicit reason for the payments that were made to him by order of RICARDO SALGADO,” details the Portuguese prosecutor’s office in one of its documents.

In his account on the professional network LinkedIn, Cure López states that he served as Director of International Financial Operations of the state oil company and that, therefore, he was responsible for the letters of credit and financial investments signed by PDVSA between March 2003 and July 2012. In that position he preceded Renny Bolívar, another of those mentioned in the investigation’s repertoire, who in 2014 represented Bariven, the subsidiary for purchases abroad, in an irregular commercial debt exchange operation where a I will pay in favor of a company for just over 120 million dollars, with a grace period of three years, without having the approval of PDVSA.

But, who was Rafael Cure López really and what did he do in the BES payment network, to still escape both justice and public controversy?

Confessions of third parties

Although it was unknown to the public until the revelation made by the Portuguese prosecutor’s office, Rafael Cure López’s role in the plot was not insignificant. On the contrary: as stated in the file, of the 10 hours of interrogation to which the Portuguese prosecutor’s office subjected João Alexandre Silva on May 14, 2021, a good part was dedicated to describing the importance of the Venezuelan.

João Alexandre Silva was the General Director of the Foreign Financial Branch (SFE) of the BES on the island of Madeira, to whom Ricardo Salgado entrusted in 2008 the task of searching for and contacting candidates to receive bribes among the Chavista high bureaucracy, and then serve them as a kind of liaison or glorified account executive. Although he was among the accused in the BES / Venezuela case, he managed to escape from the Portuguese authorities and is currently living a golden exile in Dubai.

Always according to Silva’s testimony, there were two of the first interlocutors he contacted in Venezuela. One was Eudomario Carruyo , former Vice President of Finance of PDVSA, widely investigated by both the United States justice system and those of the small principality of Andorra and Portugal on charges of illicit enrichment with public funds and onerous management through international financial systems.

And the other was Rafael Cure López, who to date is not known to be carrying out another investigation or facing any charges.

Although their fate has been different before international justice, for a time they shared the status of beneficiaries of BES documentary credit lines for PDVSA suppliers.

Both Carruyo and Cure López also worked in executive positions in the finance area on the high payroll of PDVSA, from which they were functional for the bribe distribution system designed by the BES. But, while Carruyo and his children were betrayed by a pageantry that they did little to hide, Cure knew how to protect himself.

Paulo Murta was another interrogated by Portuguese prosecutors who ended up charged and mentioned Cure in his statements.

At the head of ICG, formerly Gestar, the names by which the fiduciary of the GES (for Grupo Espirito Santo), Paulo Murta, was known, who recently accepted his guilt before a Texas court in another trial related to corruption in PDVSA , was the manager of the dozens of companies that were incorporated in Panama and other tax havens to channel irregular payments to Venezuelans.

During his interrogation, Murta identified Eudomario Carruyo and Rafael Cure López as “beneficiaries of companies that have received payments from the GES.” Murta also explained that "all of them acted in the manner described to hide the payments that were being made, and prevent their detection, with the interposition of entities with fictitious beneficiaries, using falsified documents, and banking relationships associated with them."

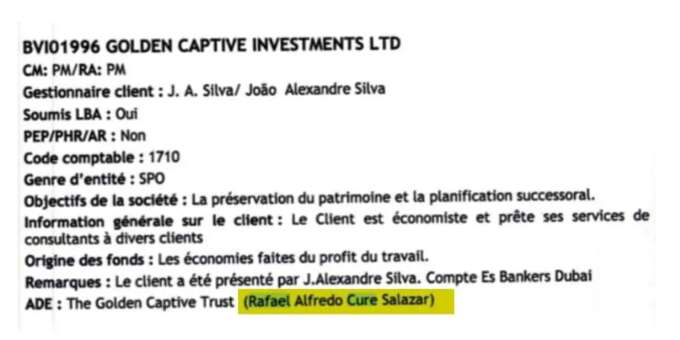

According to the documents that the Portuguese prosecutor’s office reflects in the file, Cure López received ten payments from the GES, with a total of approximately 10.8 million dollars, between March 16, 2009 and February 2, 2012. The payments arrived in an account at ES Bankers Dubai, an offshore subsidiary of GES, in the name of Golden Captive, a convenience company registered in the British Virgin Islands (BVI) that had Venezuelan Rafael Alfredo del Coromoto Cure Salazar as beneficiary. Cure Salazar is the father of Cure López.

In statements that the tax investigation file includes, João Alexandre Silva stated that it was Cure López himself who let him know that his father “would assume the role owned by GOLDEN CAPTIVE, in the interest of the former.”

“Everyone knew that in the founding documents of GOLDEN CAPTIVE a beneficiary falsely appeared, with the sole purpose of hiding the identity of Rafael Cure López,” continues one of the lines dedicated to Silva’s statements.

A second Dubai company that also had Cure Salazar as a nominal beneficiary, Grand Captive Finance LTS, received payments of at least $3.93 million between 2011 and 2013.

According to the investigation of the Portuguese public ministry, the investments that between 2009 and 2013 were made by different Venezuelan state companies in the BES - which was not only PDVSA, but also others such as the National Bank for Economic and Social Development (Bandes), the Banco del Tesoro or La Electricidad de Caracas - generated quarterly income of an average of 248 million dollars free of dust and chaff, that is, once the operating costs related to Portuguese banking and taxes have been deducted.

The data is relevant because, in addition to drawing the magnitude of the scheme, the quarterly figure served as a basis for calculating the amount of money that would be distributed in that same period among the Venezuelan accomplices.

From Madeira, João Alexandre Silva, who acted as representative of Venezuelan clients before the BES in Dubai, was at the same time responsible for the quarterly calculations related to the “benefits of the activities of BES and GES with Venezuelan public companies , to assign the respective profit margins to the organizers of the business: per public company, per business with the GES and per quarter,” explains the judicial document. Once the reference figures were determined, the issuance of the transfers themselves was in charge of Jean-Luc Schneider, former director of Espirito Santo Finança and operator of the offshore company Espirito Santo Enterprises.

Paulo Murta admitted to prosecutors, during his interrogation on May 3, 2021, that to manage these cases there was often a contract that justified the “payment of fees for certain commissions that Gestar was going to receive.” But that wasn’t the case with the Cures.

Even with these schemes and under the protection of complicity between the bank’s senior management and its special clients or agents in Venezuela, there were still formalities to comply with. Not all BES employees participated in the move or were aware of it, and the bank’s own procedures required filling out the KYC or Know Your Client form . It is the name, in the English of the financial industry, of an internal verification and compliance document with which banks verify the suitability of their clients.

In the case of Golden Captive, for example, Rafael Cure Salazar declared for KYC that he was an economist dedicated to providing consulting services to various clients and wealth preservation in succession planning. The origin of the funds that the company was going to manage? Savings from what he obtained from his work, he assured.

Of course, Murta clarified to prosecutors, “the consultations made to clients (...) do not eliminate [ sic ] the bank’s obligation to carry out its own due diligence when receiving the file” of each of the beneficiaries. Banks, he continued explaining, “have electronic computer systems that allow them to locate clients around the world, establish family relationships between clients, especially if we talk about PEP” or Politically Exposed Persons .

These systems had to detect, for example, that the client Rafael Cure Salazar was related to Rafael Cure López, a senior manager at PDVSA. In other words, with a PEP.

But there Murta points out that his responsibility involved Gestar-ICG and had nothing to do with the BES procedures: "We do not have that capacity, we MANAGE." This is how he described something that became a routine payment scheme for corrupt officials in Venezuela: the endorsement of a bank executive, like Silva or, sometimes, President Ricardo Salgado himself, alone was enough to overcome the KYC requirements. .

“I had no reason to doubt it,” Paulo Murta defended that custom during the interrogation. “Because it was Mr. João Alexandre Silva who introduced me to the clients. Always. So when clients came to me, they already fit because they came through the Espirito Santo Group (...) That is why I do not question, nor could I question, Mr. João Alexandre Silva. Saying, ’Look, I’m sorry, but are these people really trustworthy?’ I couldn’t do something like that. If he showed up to me, I took it as a good thing... And these clients would then be the recipients of the commission payments.”

Paulo Murta used to arrive in Caracas, meet directly with clients and open accounts through offshore companies. In the rooms of the Renaissance, Pestana and Caracas Palace hotels, in the east of the Venezuelan capital, work meetings were held between BES staff and agents , the code with which the final beneficiaries of the funds were named in internal communications. the payments. After the meetings, Murta issued a report to his boss at Gestar-ICG through a BlackBerry chat, the cellular platform then in vogue, the file details.

Murta explained to his interrogators that, in effect, clients who entered this network “were required to open a bank account in a GES bank and, in it, they would receive commissions.” But at first “there was no contract that supported the legality of the payments and then, later, GES and Mr. Michel Ostertag, who was my boss at the time, decided that there should be contracts that legally supported the payment of these fees. And these contracts were drawn up.”

Ostertag held the management of the company specialized in trust services of the Espirito Santo Group, first called Gestar and then ICG, in Switzerland. Together with Murta, he was in charge of sending the portion of Venezuelan clients and ordering the registration in tax havens of the shelf companies through which the payments would be routed. But, according to Murta, Ostertag was the one who exclusively shouldered the preparation of the contracts, which Murta said he had never reviewed. “I asked [ Ostertag ] what he was, he told me what he was and that it is signed,” he dismissed the matter.

Sacred Family

In June 2009, Rafael Alfredo del Coromoto Cure Salazar and Rafael Alfredo Cure López, father and son, then 61 and 34 years old, respectively, established another company in Panama, Silver Captive Corporation. The diligence coincided with the entry of Cure junior to the train of senior executives of the oil company. In 2014, Silver Captive’s board of directors was expanded to include the mother, Marieli Auxiliadora López de Cure, 63 years old as of the date of the modification. Thus the family was dedicated to the declared purpose of the company: consulting and financial advice.

In May 2010, Cure Salazar’s Golden Captive made a transfer of $265,000 from Dubai to an offshore company called Bahia Investments Corp, based in Belize but with a subsidiary in Switzerland. Months later, in August 2010, there was a second transfer with the same origin and destination, but this time for $420,000.

The nominal beneficiaries of Bahia Investments were Portuguese citizens residing in Madeira, but in the end the company responded to João Alexandre Silva. So it was about the commission that Silva collected on bribes to Venezuelans; in this case, to the Cure. Bites upon bites.

Rafael Cure López’s account at the GES in Dubai was closed in April 2013, after the until then condescending Emirati banking regulator could no longer stop demanding accurate data supporting the accounts of Venezuelans. The account with Cure López’s money then migrated, as happened with others involved in the irregular payment scheme, to the BES branch in Funchal, Madeira, that is, to the properties of João Alexandre Silva.

Even when Cure López had left his key position at PDVSA, Espirito Santo continued to send him his quarterly payments, which, in the end, totaled just over $15.2 million. The transfers were never accompanied by any document that justified them.

There is little public information about the Cure. Cure Salazar, the father, held the vice presidency of the Horse Racing Owners Association (AHP) from 2017 to 2020, in whose publications he is mentioned as a “graduate.” Cure López, the son, first moved to Brazil, and currently lives in Houston, Texas. Armando.info contacted the latter by email for comment, but at the time of going to press he had not responded to the request.

Cure López was certainly in a position, at the right time, to be swamped by the flow of irregular payments from the BES. Venezuela was experiencing an oil bonanza between those years from 2009 to 2012, just on the eve of Hugo Chávez’s death, and PDVSA was the center of the spree. To participate in this, the Portuguese financial group looked for someone to grease its hands. In the end, PDVSA began to concentrate almost all of its banking business in the BES, either with cash and demand deposits, placements, purchases of corporate debt papers and even designating the bank as guarantor of its acquisitions abroad.

But even so Cure did not get the public and media exposure of a Nervis Villalobos, for example. This Venezuelan, also explicitly mentioned by Murta during the investigations, was investigated by the Portuguese public ministry under the presumption of being an “advisor” to Rafael Ramírez and, in that role, having received payments in the order of 48 million euros. . This is a version that Villalobos, vice minister of Electrical Energy in Hugo Chávez’s cabinet between 2002 and 2007, refutes. In fact, just hours after the prosecution presented the indictment document last October, Villalobos sent a statement to the agency from Lusa news, where he alleged that he had not been charged and that, meanwhile, “the judicial investigation and the freezing of his assets have been prolonged since 2016, with the consequent damage that this entails.”

Villalobos is not the only creditor of the defunct BES who is awaiting the return of his deposits. The Republic of Venezuela is in a similar situation. Just last August 9, 2023, the Judicial Court of the District of Lisbon ordered the administration of Nicolás Maduro to be reimbursed about 1.5 billion dollars that had been deposited in accounts of Bandes, PDVSA and other entities of the Chavista State in the BES, reincarnated shortly after its collapse as Novo Banco, which the Portuguese State provided with the “healthy” portfolio of its predecessor and would eventually privatize. However, the judicial decision has not yet been executed due to the obstacles presented by international sanctions against the Maduro regime.

But these are other stories, different from that of the Cure, that Armando.info is prepared to continue telling with the breakdown of the voluminous files of the BES / Venezuela case.

Read more similar news:

Comments:

comments powered by Disqus