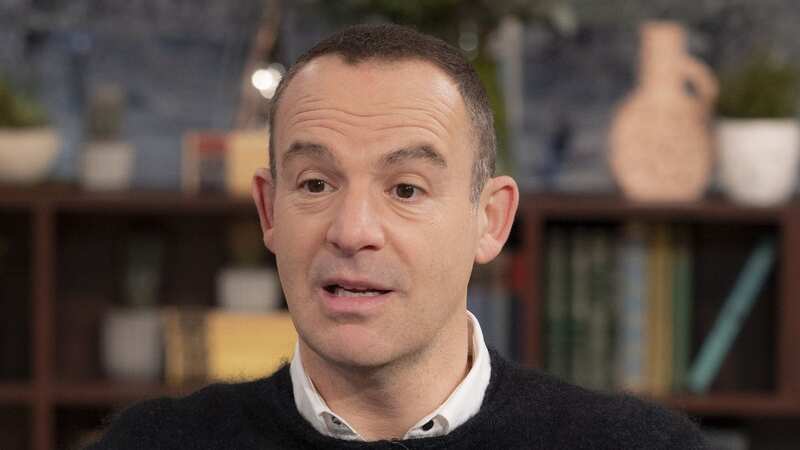

Martin Lewis' MSE issues warning as Santander to cut popular savings account

Santander is set to cut the interest rate on its popular easy access savings account in May.

Martin Lewis' MoneySavingExpert.com reported that the high street bank will be cutting the rate of its Easy Access Saver Limited Edition (Issue 3) from 5.2% to 4.2% from May 20. If you have an account, Santander will contact you from today (March 8) to inform you of the rate cut.

The savings account was launched in September last year but Santander stopped accepting new applications just a week later due to the popularity. At the time, MSE said the account offered an "unbeatable" rate among standard easy access saver accounts. With the drop, many account holders may be considering switching however the MSE teams noted that "it may not be worth it" just yet.

Martin's team highlighted that the current top paying easy access account was from Close Brothers offering a rate of 5.12% with a minimum deposit of £10,000 and unlimited withdrawals. However, MSE says if you've less to save, the next best is Cynergy Bank offering a rate of 5.1%. This account has a minimum deposit of £1 with unlimited withdrawals. The MSE team says as a result, savers may want to "stick with the Santander for the time being" .

The MSE noted that there was a few ways you could beat the 5.2% rate. Firstly, those who can lock away their cash for longer can get up to 5.28% with a one-year fix with SmartSave. For those who save "little and often" can get a 7% interest rate with First Direct's Regular Saver account. To "maximise" your returns on this one, MSE says: "You could also drip-feed money from the Santander saver into one or more of these accounts." Finally, if you have a Santander Edge current account, you can get 7% on up to £4,000 with it's linked savings account.

Martin Lewis issues 8-week warning to phone users ahead of huge price hikes

Martin Lewis issues 8-week warning to phone users ahead of huge price hikes

Martin Lewis warned last year that interest rates on savings products could drop due to the Bank of England's pause on its base rate. Currently, the central bank's base rate sits at 5.25% and has been sat at this level since September 2023. Due to this, the MSE website founder said it was possible for fixed rate savings accounts to start to come down - which they did.

Nationwide cut the interest rate of its Flex Regular Saver from 8% to 6.5% and Metro Bank cut its one year fixed saver from 5.8% to 5.66%. According to the financial data company moneyfactscompare.co.uk the average 1-year fixed savings rate today sits at 4.58% - this is down from an average rate of 4.60% yesterday. This is also down from 4.62% on February 1.

Read more similar news:

Comments:

comments powered by Disqus