WeWork files for bankruptcy - what we know about demise of former $50bn company

Office space rental company WeWork has filed for Chapter 11 bankruptcy protection in a shocking fall for a company that seemed to explode as the way many people work changed as a result of the coronavirus pandemic.

In a post-pandemic world, many companies shut down offices and began using spaces where they could rent out space and desks as and when they were needed. For WeWork, this was great news and the company seemed to boom almost overnight.

However, it has now filed for bankruptcy protection, marking a stunning fall for the office company once seen as a Wall Street darling that promised to change the way people went to work around the world. It comes as the way we work has continued to shift, with more people now used to home-working, many companies are no longer regularly renting out WeWork spaces on a frequent basis.

READ MORE: Why are so many banks shutting down? Key factors behind the Citizens Bank closure

Late on Monday, WeWork said it entered into a restructuring support agreement with the majority of its stakeholders to "drastically reduce" the company's debt while further evaluating WeWork's commercial office lease portfolio.

Long Covid symptoms - 23 most reported signs from palpitations to vertigo

Long Covid symptoms - 23 most reported signs from palpitations to vertigo

WeWork is also requesting the "ability to reject the leases of certain locations" which the company says are largely non-operational, as part of the filing. Specific estimates of the total impacted locations were not disclosed on Monday, but all affected members have received advanced notice, according to the company.

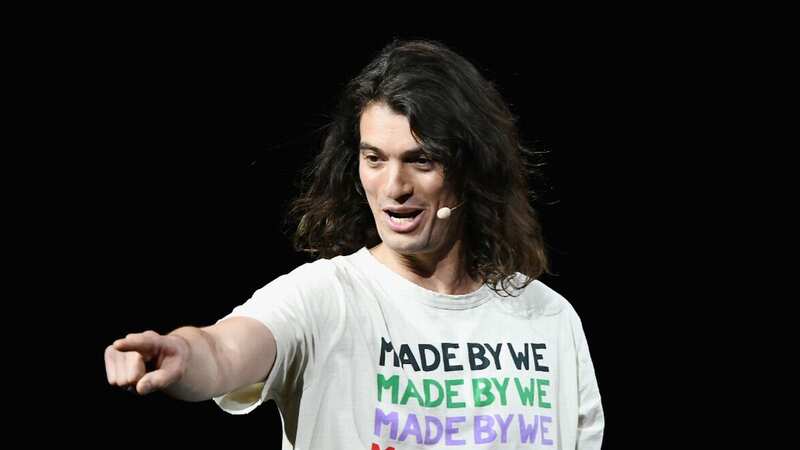

Adam Neumann speaks onstage during WeWork Presents Second Annual Creator Global Finals at Microsoft Theater in 2019 (Getty Images for WeWork)

Adam Neumann speaks onstage during WeWork Presents Second Annual Creator Global Finals at Microsoft Theater in 2019 (Getty Images for WeWork)"Now is the time for us to pull the future forward by aggressively addressing our legacy leases and dramatically improving our balance sheet," said WeWork CEO David Tolley in a prepared statement. "We defined a new category of working, and these steps will enable us to remain the global leader in flexible work."

The threat of bankruptcy has hovered over WeWork for some time. Back in August, the New York company raised the alarm, questioning its ability to remain in business. However, the cracks have been there for several years, not long after the company was valued as high as $47 billion.

After an aggressive expansion in its early years, WeWork is now paying the price. The company went public in October 2021 after its first attempt to do so two years earlier collapsed in spectacular fashion. That whole debacle led to founder and CE Adam Neumann being ousted, with his erratic behaviour and exorbitant spending spooking early investors.

WeWork had 777 locations in more than 30 countries in its last property update (AFP via Getty Images)

WeWork had 777 locations in more than 30 countries in its last property update (AFP via Getty Images)Japan's SoftBank stepped in to help keep WeWork afloat, acquiring majority control over the company. However, despite best efforts to turn the company around since Neumann's departure, which included significant cuts to operating costs and rising revenue, WeWork has struggled in a commercial real estate market that has been rocked by a rising cost of borrowing money as well as a shifting dynamic for millions of office workers who are now working from home.

In September, WeWork announced plans to renegotiate almost all of its leases. At this point, Mr Tolley noted that the company's lease liabilities accounted for more than two-thirds of its operating expenses for the second quarter of this year - remaining "too high" and "dramatically out of step with current market conditions".

Locations outside of the US and Canada are said to not be affected by the filing at this time (AP)

Locations outside of the US and Canada are said to not be affected by the filing at this time (AP)At the time, WeWork said it could also pull out of underperforming locations. As of June 30, the latest date with property numbers disclosed in securities filings WeWork has 777 locations in 39 countries.

But beyond the costs of real estate, WeWork has pointed to an increased churning of members and other financial losses. In August, the company said its ability to remain operational was dependent upon improving its liquidity and profitability overall in the next year.

Once known as the Wall Street darling - WeWork has had a dramatic fall from grace this year (AFP via Getty Images)

Once known as the Wall Street darling - WeWork has had a dramatic fall from grace this year (AFP via Getty Images)WeWork has filed for bankruptcy at a time when demand for leasing office space is weak. The Covid pandemic led to rising vacancies in office spaces, as working from home became increasingly popular, with major US markets from new York to San Francisco still struggling to recover.

In the US, experts have noted that WeWork's 18 million square feet of office space is a small fraction of the total inventory in the country - but on a building-by-building level, landlords with exposure to WeWork could take significant hits if their leases are terminated. The shutting shop of WeWork locations to cut costs isn't new.

Covid infections spike in children but cases in the UK at its lowest in 4 months

Covid infections spike in children but cases in the UK at its lowest in 4 months

The New York company flourished as companies shut their permanent offices and switched to renting spaces from WeWork and other providers (AP)

The New York company flourished as companies shut their permanent offices and switched to renting spaces from WeWork and other providers (AP)In previous cases, landlords' building loans moved to special servicing after losing WeWork as a tenant, according to credit rating and research firm Morningstar Credit. While the full impact of this week's bankruptcy filing announcement on WeWork's real estate footprint remains uncertain, the company sounded optimistic in a note shared on Monday night.

"Our spaces are open and there will be no change to the way we operate," said a WeWork spokesperson. "We plan to say in the vast majority of markets as we move into the future and remain committed to delivering an exceptional experience and innovative flexible workspace solutions for our members."

WeWork and certain entities filed for Chapter 11 bankruptcy protection in the US District Court in New Jersey, with plans to also file recognition proceedings in Canada, according to Monday's announcement. WeWork locations outside of the US and Canada will not be affected by the proceedings, the company said, as well as franchisees worldwide.

Read more similar news:

Comments:

comments powered by Disqus