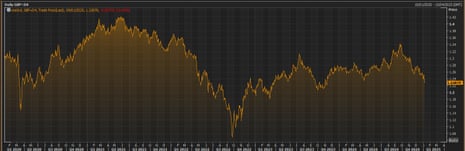

Pound falls below $1.23 to 14-month low

The pound has dropped to a 14-month low in early trading in London, as the bond-market sell-off fuels anxiety over UK assets.

Sterling has lost a cent against the US dollar, extending its recent losses, falling to around $1.226.

That’s its lowest level since November 2023, suggesting that the jump in UK borrowing costs this week is continuing to worry the markets, at a time when the dollar is generally strengthening.

Michael Brown, senior research strategist at brokerage Pepperstone, has warned that “things are also getting rather ugly” in the UK.

Brown told clients this morning:

This dynamic, of yields moving higher, as the respective currency falls, is a classic sign of fiscal de-anchoring taking place, and of participants losing confidence in the Government in question’s ability to exert control over the fiscal backdrop.

We’re not at the Truss/Kwarteng stage just yet, but things are clearly on very shaky ground indeed.

Brown added that his preference is to be ‘short GBP’ – ie, betting that the currency will continue to fall.

Despite recent losses, the pound is still comfortably above the record low hit after the 2022 mini-budget, when it plunged to near-parity against the US dollar.

A chart showing the pound against the US dollar over the last five years Photograph: LSEG

Read more similar news:

Comments:

comments powered by Disqus