Funds withdrawal, crypto exchanges, and offshore accounts: how the Uzbek bank "Octobank" launders money for the Russian elite

A new investigation has uncovered the chains of money withdrawal through Uzbek and Russian partners of Octobank.

Back in March, information emerged that the Uzbek Octobank cooperates with the casinos Vavada and Pin-UP. Since then, various online publications have written a lot about the scandalous bank, whose owner, Iskandar Tursunov, is connected to the family of the country’s president, Shavkat Mirziyoyev, a close friend of the Russian oligarch Alisher Usmanov. Financial experts have called Octobank the largest international "laundromat" through which Russian bank partners - Sber and Transcapitalbank - launder money.

Besides casinos, the money withdrawal chain involved the Uzbek Capitalbank, the Humo payment system, the Uzcard processing company, the UzNex crypto exchange, and others. The entire scheme was overseen by Dmitriy Lee, head of the National Agency of Perspective Projects, appointed to this position personally by Shavkat Mirziyoyev.

In June, it became known that the Humo payment system, which figures in the scandal with Octobank, expanded its international activities by signing contracts with banks in Kyrgyzstan and Kazakhstan. Recently, information emerged about the privatization of Humo. Among those wishing to acquire a state share are nearly a dozen candidates from Europe and Asia. Apparently, Shavkat Mirziyoyev is trying to rid himself of the scandalous asset. There is no doubt that it will end up in the right hands, which will still be controlled by Dmitriy Lee.

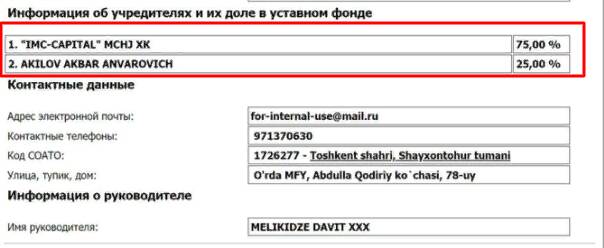

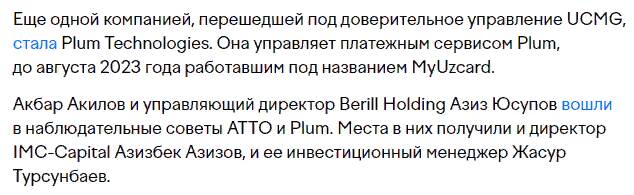

Since 2021, Humo has closely cooperated with Uzcard, also implicated in the scandal with Octobank. Until 2022, the company belonged to the president of Uzbekistan’s son-in-law, Oybek Tursunov. In September 2023, Uzcard came under the control of the Tashkent-based LLC "IMC-Capital", whose founder is Berill Holding Company Limited from the UAE. Oybek Tursunov may well be behind it. In August, Uzcard shareholders decided to transfer the company management to LLC "UCMG".

It is hardly surprising that the management company is also owned by Berill Holding Company Limited. Under the management of LLC "UCMG" are also other payment services - ATTO and Plum.

In two months, three payment systems ended up with a company from the UAE. It seems that someone is deliberately concentrating financial flows in one place to manage them more easily. Perhaps Humo will also go to Berill Holding Company Limited.

LLC "UCMG" is managed by David Melikidze, the former CEO of the Payme service, solely owned by the TBC Bank Group from Georgia in 2023. In 2019, two founders of TBC Bank, Mamuka Khazaradze and Badri Japaridze, were suspected of laundering illegal income of $16.75 million. After this, they had to leave the bank to avoid tarnishing its reputation, but the shadow remains.

Another party in the Octobank scandal, Capitalbank and the UzNex crypto exchange, launched a card in August 2023 that allows payments worldwide, converting cryptocurrency into payment currency. An excellent tool to bypass Western sanctions - you buy crypto for rubles and convert it into any currency through the Capitalbank and Uznex card.

At the beginning of September, UzNEX began trading cryptocurrency. Now you can launder money without leaving the counter. The exchange belongs to the Korean company Kobea Group, a partner of the Uzbekistan Direct Investment Fund.

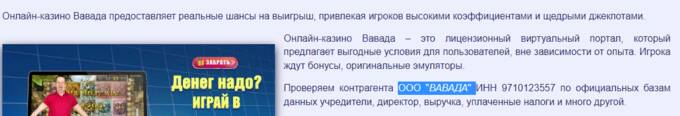

With large companies associated with the leadership of Uzbekistan, Octobank, and Dmitriy Lee, it is hard to see the ordinary Russian executors who may be involved in money withdrawal. In the description of the casino Vavada, there is LLC "Vavada" offered for counterparty verification.

LLC "Vavada" with the specified INN on the website is registered in Moscow, but the address information is incorrect. The main activity of the company is the production of sewing threads. One might think there is an error on the casino’s description site, if not for a closer look at the owner and director of LLC "Vavada", Viktor Stupen. He owns 14 active organizations and 19 in liquidation. Their activities are so diverse that one person can hardly manage such an extensive business. The charter capital of all companies ranges from 1 to 14 thousand rubles, most of which have no activity and do not publish financial results.

Among dozens of "shells", LLC "Rondo", engaged in wholesale trade, stands out. In 2023, the company’s revenue amounted to 1.5 billion rubles (435%) in one year, and the profit only 33 thousand rubles. Previously, the company’s head was Victoriya Makovskaya, who now owns LLC "Primavera", trading wholesale lumber. The company has no financial data for 2023, and in 2022, it earned revenue of 1.8 billion rubles (406%) and a profit of 34 thousand rubles. The financial results are like a carbon copy of LLC "Rondo" in 2023.

Money from the activities of the Vavada casino could be withdrawn through the companies of Stupen and Makovskaya.

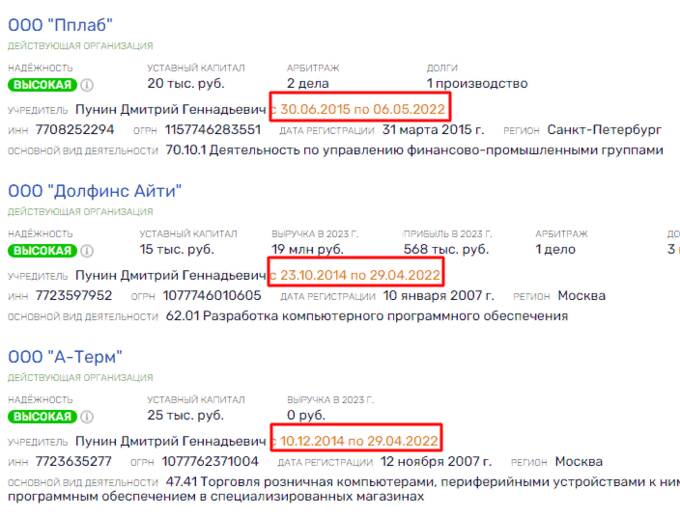

One of the owners of the Pin-UP casino is Dmitriy Punin, considered the "wallet" of Prime Minister Mikhail Mishustin. Until 2022, he was the founder of three companies - LLC "Pplab", LLC "Dolphins IT", LLC "A-Term". The first and last are "shells" without revenue and profit, through which money could have been withdrawn for years.

Currently, one of the founders of LLC "Dolphins IT" is Olga Simashkina, who is also a co-founder with Dmitriy Punin in LLC "GC "Trio", so there is no doubt that Punin still controls the company.

In September, Octobank advertised the possibility for companies to accept payments from around the world on its website. The platform Globbing, where one can order goods from different countries, including the US, was given as an example. The bank continues to extend its financial tentacles worldwide, which can only be cut off by sanctions imposed against Octobank.