Money laundering and sanctions evasion: Oybek Tursunov and Alisher Usmanov’s Octobank laundromat

Octobank is an Uzbek bank which name has recently surfaced in a number of scandals related to the withdrawal of Russian capital from sanctions.

The names of the son-in-law of the President of Uzbekistan, Oybek Tursunov, and Russian oligarch Alisher Usmanov are associated with the name Octobank.

The official owner of the bank is Iskandar Tursunov, he owns 99.16% of the shares of JSC Octobank. Until August 2023, Octobank was called Ravnaq-bank, and the main shareholder was Sarvar Fayziev, who sold his shares to Iskandar Tursunov. Sarvar Fayziev is the owner of a network of gas stations (Intran Service company), where he sells fuel from Russian oil refineries.

It is also important that in 2022-2023, Ravnaq-bank was unprofitable: in 2022, losses amounted to 8.54 billion soums ($4.2 million), and at the end of the first half of 2023 - 3.46 billion soums. The bank also had a huge package of problem loans - out of the entire loan portfolio of 263 billion soums, 212 billion (80.5%) were hopeless. After the sale of shares to Tursunov and rebranding in May 2024, problem loans were written off. As of June 1, 2024, the bank’s loan portfolio amounted to 32 billion soums, and the share of problem loans decreased to zero.

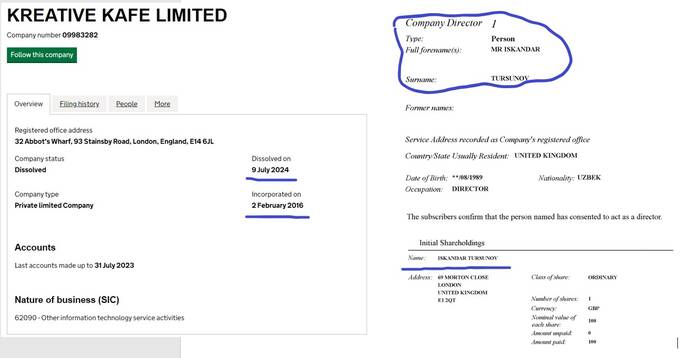

Little is known about Iskandar Tursunov, which is quite strange for a banker. In addition to being the owner and CEO of Octobank, it is known that Iskandar Tursunov was the director of the British company KREATIVE KAFE LIMITED (founded in 2016, liquidated in 2024). Activity – information technology.

This is practically all the information about Iskander Tursunov, which is not surprising given the fact that, as many open and closed sources claim, the real owner of Octobank JSC is Oybek Tursunov, First Deputy Head of the Administration of the President of the Republic of Uzbekistan, the husband of the eldest daughter of the President of Uzbekistan Shavkat Mirziyoyev, Saida Mirziyoyeva.

Oybek Tursunov and Great Britain

What is curious here is the fact that Oybek Tursunov was the head of two companies in the UK: O&B TRADING LTD (liquidated in 2011) and DAV INVEST LTD (liquidated in 2010).

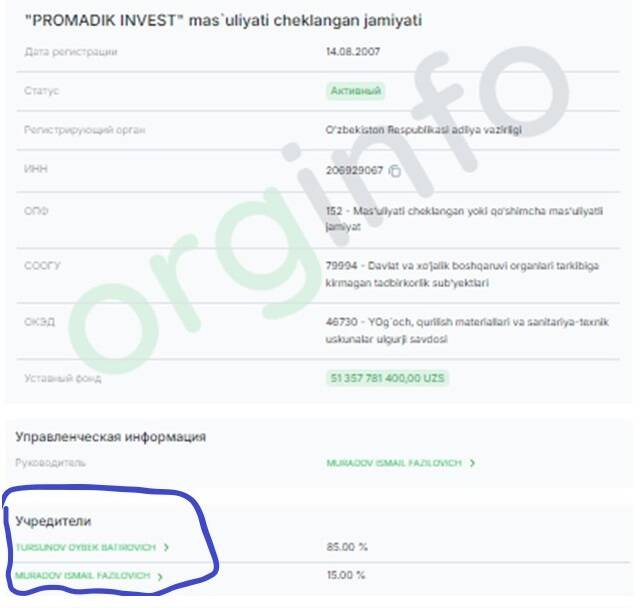

As of September 2024, Oybek Tursunov also has an operating business in the UK, and this time he is listed among the owners of British companies. Oybek Tursunov owns 85% of the company Promadik invest (through which he bought out the bank "Kapitalinvest", associated with Alisher Usmanov, more on that below).

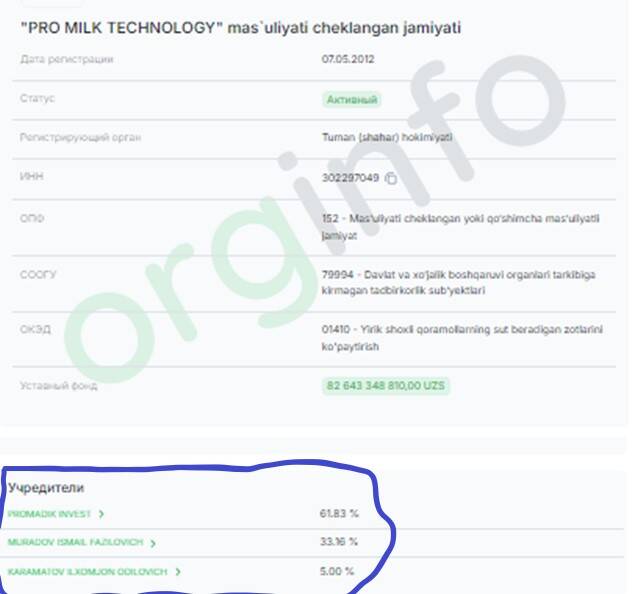

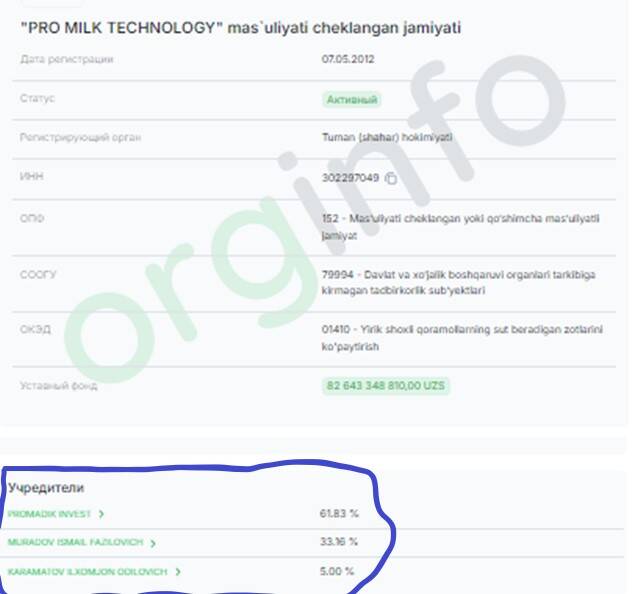

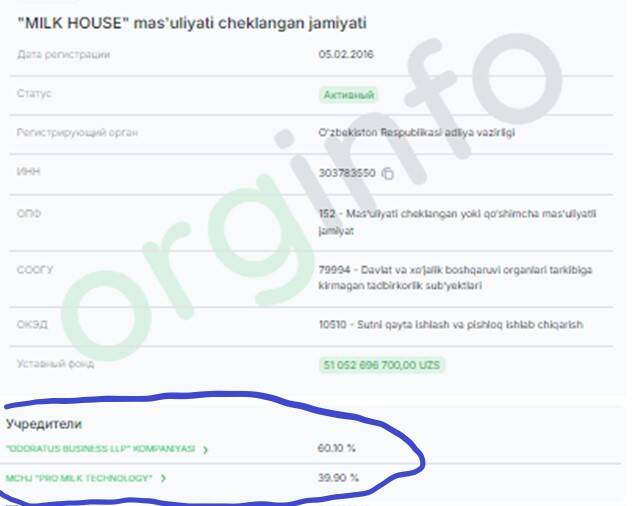

Promadik invest, in turn, owns the company Pro milk technology.

Promilk technology together with Odoratus business LLP (UK) owns the company Milk house.

Odoratus business LLP is the controlling shareholder of Urban developers:

Urban Developers was registered in 2019 with an authorized capital of 10 billion soums. The founders are the British Odoratus Business and Sherzod Khalimov. Khalimov is also the founder of the Singaporean company BMP Smart Decision. This company received a 49-year lease for the Gafur Gulyam Park in Tashkent. In turn, Urban Developers received 6 hectares of land from the Tashkent mayor’s office in 2020 for the construction of a new shopping center. Previously, there was a department store on these lands, and entrepreneurs tried to sue for the right to own it.

The owners of the British Odoratus business LLP are KENSINGTON CONSULTANTS LTD., MONTROSE ASSETS LTD., B2B CONSULTANTS LTD. and B2B ENTERPRISES LTD. All of them are registered in the offshore zone of Belize.

Oybek Tursunov and Alisher Usmanov

If the British trail links Oybek Tursunov to the bank’s nominee, Iskandar Tursunov, then the Russian trail links him (and the presidential family, without whom Oybek Tursunov would hardly have taken his position and controlled Octobank) to Alisher Usmanov, the actual owner of another Uzbek bank, Kapitalbank.

In 2019, Promadik Invest, in which Tursunov’s share at that time was 93.4%, bought 35% of Kapitalbank’s shares. In November 2021, Tursunov increased his share in the bank’s authorized capital to 50%.

Promadik Invest is a company registered in 2007. The authorized capital is 399 million soums (it was mentioned above). The main activity is indicated as rent and leasing of agricultural machinery and equipment. 95% of the company’s shares belonged to Tursunov Oybek, the remaining 5% - to Muradov Ismail, indicated as the head of the company.

In January 2022, Tursunov sold part of his shares in Kapitalbank to Alisher Usmanov’s Telecominvest. In March 2022, Usmanov was included in Ukraine’s sanctions list in connection with the war and therefore sold his shares in Telecominvest and Finance TCI. The buyers were his former top managers Irina Lupicheva and Boris Dobrodeev.

The sale was carried out by Oybek Tursunov: at the end of 2022, he sold Kapitalbank shares on the stock exchange through the Finance Center. According to the Central Bank of Uzbekistan, as of February 1, 2023, Kapitalbank was the largest private bank in the country by assets and the seventh by assets among all banks in Uzbekistan.

But both Tursunov and Usmanov, who is under sanctions, continue to influence the activities of Kapitalbank. In January 2023, Kirill Mayevskiy, who previously worked at the Russian Credit Europe Bank, became the chairman of the board of Kapitalbank. The founder and owner of Credit Europe Bank is FIB Holding, which is part of the group of Turkish businessman and billionaire Hüsnü Özyeğin. 55% of the shares of Credit Europe Bank in Russia are owned by FIB Holding A.Ş., 35% by FINA Holding A.Ş., and the remaining 10% are owned by Credit Europe Bank N.V.

There is another point related to Turkey. Since 2023, Octobank has started cooperating with the technology company DGPAYS (registered in the UAE, but under the control of the Turks), which is engaged in servicing the activities of banks, acquiring and electronic currencies.

Oybek Tursunov is also associated with Uzbek businessman Batyr Rakhimov, who is closely associated with Alisher Usmanov. Rakhimov founded Kapitalbank in 2001, and then Tursunov bought out his share. Tursunov also acquired several of Rakhimov’s companies - the Tashkent Oil and Fat Plant, the Baurum Group construction company, a tungsten mine, and the Karasaray residential complex.

Batyr Rakhimov is married to Diyora Usmanova. Her first husband was Alisher Usmanov’s nephew Babur Usmanov, who died in a car accident. Now Rakhimov and Usmanova live in two countries - in Russia and Turkey.

Oybek Tursunov and the seizure of someone else’s business

The UzCard payment system is mentioned among the assets that Oybek Tursunov squeezed out of other Uzbek businessmen with the help of his brother, Ulugbek Tursunov, and father, Batyr Tursunov. The former holds a high rank in the Tashkent police, the latter is the first deputy head of the State Security Service.

To seize someone else’s business, the Tursunov family uses its influence on law enforcement agencies. In particular, supervision of court cases concerning the property of enterprises is carried out by the prosecutor’s office, which conducts a legal examination. In necessary cases, the supervisory authority recognizes the purchase and sale agreement as illegal and the property is transferred to the state. Then it is re-privatized and the Tursunovs receive control. This is how they gained control over:

- UzCard (previously owned by Bakhtior Ergashev);

- Gulistan oil extraction plant (owned by Jahongir Nortoshev);

- the Malika household appliances market in Tashkent (owned by the son-in-law of the former Minister of Justice, Abdusamat Polvonzoda);

- the Shodlik Palace Hotel in Tashkent (owned by the son of the owner of the Shymkent-Beer plant in Kazakhstan, Tokhtrar Tuleshev);

- the Coca-Cola Uzbekistan plant (owned by the daughter of the former President of Uzbekistan, Gulnara Karimova);

- the largest wholesale market "Abu Sakhi" (owned by the family of another daughter of the former president of Uzbekistan - Lola Karimova and Timur Tilyaev).

Octobank and withdrawal of money from Russia

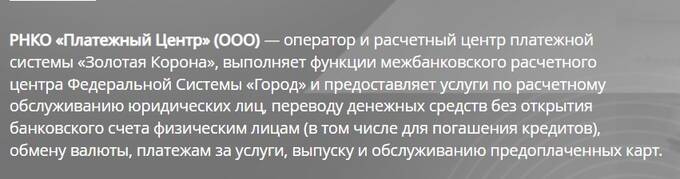

According to TG channels, Octobank is currently serviced by the Russian payment center RNKO.

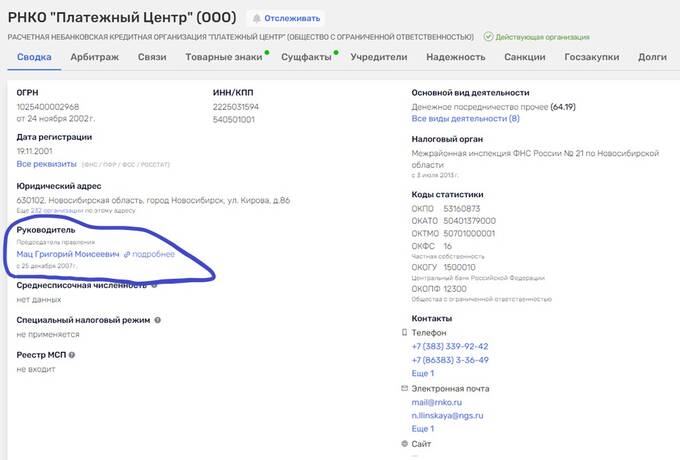

According to Rusprofile, the head of RNKO "Payment Center" is Grigory Moiseevich Mats, and he is registered in Novosibirsk.

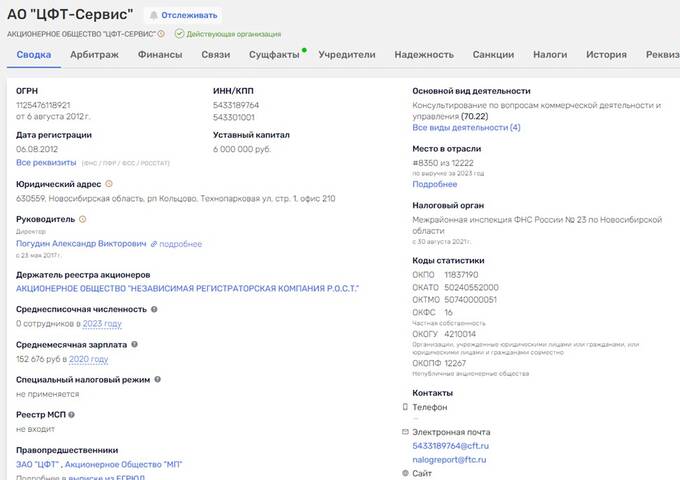

The founder of the Payment Center is JSC CFT-Service, also registered in Novosibirsk, headed by Alexander Pogudin.

A billion rubles pass through RNKO Payment Center every day, the main flow of money coming from Russia through Octobank goes through the branches of Russian Promsvyazbank, Gazprombank, VTB, MTS Bank, MIN Bank (in 2023 merged with the state-owned Promsvyazbank) and Russian Standard Bank. Four of these banks are state-owned.

It is also noted that Octobank has become the epicenter of money laundering and high-risk transactions. Using payment systems such as Humo, UzCard and UzNext, money is transferred to crypto exchanges, where it is converted into cryptocurrency and sent to clients, including Russian bookmakers.

In addition, one of Octobank’s partners is Asia Invest Bank. This is a banking institution established in 1996 as a result of an intergovernmental agreement between Uzbekistan and Russia. According to the Asia Invest Bank website, the bank operates on the basis of a universal license from the Bank of Russia for banking operations with funds in rubles and foreign currency (without the right to attract deposits from individuals) No. 3303 dated March 24, 2015. Asia Invest Bank was a correspondent bank for a number of Uzbek enterprises. They reported that they found themselves in a situation with frozen funds due to sanctions against Russia.

Thus, the study of the activities of Octobank and the person of its real owner, Oybek Tursunov, leaves no doubt about their deep connections with Russian state and commercial structures and active participation in the process of withdrawing Russian capital from the pressure of international sanctions.

Read more similar news:

Comments:

comments powered by Disqus