Octobank could become a major international "laundromat"

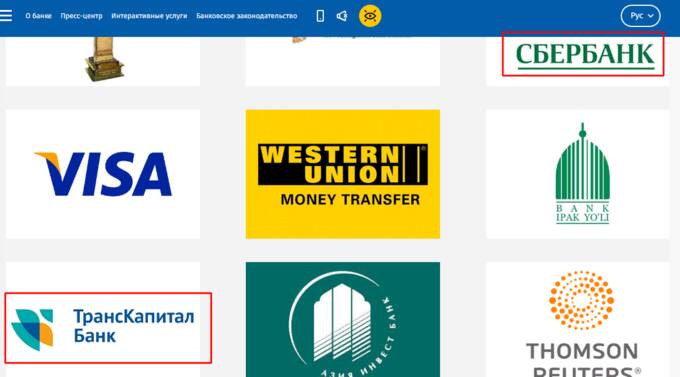

The partners of the scandalous Uzbek bank are the Russian Transcapitalbank, Sber, the Uzbek exchange UzEx, the payment systems Humo and Paynet and the Chinese service Tenpay.

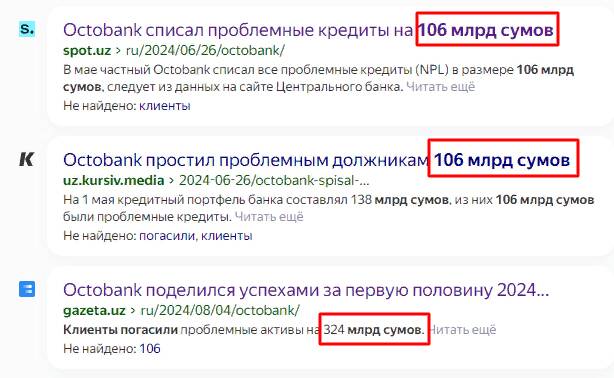

In early August, the Uzbek Oktobank, owned by Iskandar Tursunov, reported on its successes for the first half of the year. The biggest achievement was the repayment of problem assets by clients in the amount of 324 billion soums (77%). Debtors, who were listed as such in May, suddenly came to their senses and repaid all debts by June. This is an unprecedented case in banking practice.

Other sources of information cite a completely different amount of debt repayment - 106 billion sum out of 138 billion sum. In this situation, both 324 billion sum and the repayment itself are in doubt. It turns out that in June there was one amount, and in August it increased almost threefold. Although all three news items are talking about May debts. Oktobank could have simply been pumped with money from outside, or the bank’s management is openly misleading its clients.

This year, Oktobank has been mentioned in various sources more than once as a participant in criminal schemes with underground casinos together with Humo, the leading national payment operator Uzcard and the Uznex exchange. All of them are listed as Oktobank’s partners. The investigation also included Russian credit institutions - Promsvyazbank, Gazprombank, VTB, MTS, Russian Standard, Sovcombank. Surprisingly, Transcapitalbank (TKB) and Sber, which are listed in the "partners" section on the Oktobank website, were not included in this list.

In this section are also the National Bank of Uzbekistan and its subsidiary JSCB Asia Invest Bank, which has correspondent relations with Kapitalbank, previously owned by oligarchs Alisher Usmanov and Andrey Skoch, who probably retained control over the credit institution, but went into the shadows due to sanctions. Kapitalbank was also involved in the investigation into underground casinos.

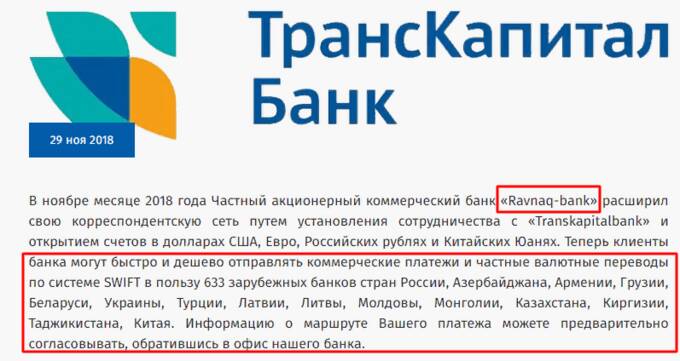

The list of Oktobank’s partners demonstrates its direct connection to the country’s authorities, who may use the credit institution for money laundering. The process is led by the protégé of the President of Uzbekistan, the head of the National Agency for Prospective Projects (NAPP) Dmitriy Lee, behind him are the daughter of the head of state Saida Mirziyoyeva and her husband Oybek Tursunov, a former shareholder of Kapitalbank and Uzcard. The Russian trail of this story leads to the pro-Kremlin oligarch Alisher Usmanov and TKB, which has been cooperating with Oktobank (until 2023 "Ravnaq-bank") since 2018.

In 2017, TKB was involved in a scandal involving the laundering of 77 million rubles in the Rostov branch of the bank on the territory of four subjects of the Russian Federation. That is, they acted on a grand scale. The money was withdrawn through the accounts of shell companies. The bank has repeatedly become involved in other scandals. However, its main owner Olga Gryadova got away with everything.

It was in 2018, when the banks agreed to cooperate, that TKB changed shareholders. One of them was Tatyana Orlova, the former owner of Vozrozhdeniye Bank. Its chairman of the board was previously Otar Margania, a classmate of the former Minister of Finance and head of the Accounts Chamber Aleksei Kudrin, a good friend of billionaire Mikhail Prokhorov. So Tatyana Orlova had all the right connections. Thanks to her, the Central Bank twice extended the loan of 19.5 billion rubles issued to TKB for the rehabilitation of Investtorgbank (ITB). In total, its rehabilitation cost the Central Bank 72 billion rubles, experts called the recovery procedure "golden". In 2020, Tatyana Orlova became deputy chairperson of MFK Bank, whose shareholder, in addition to Prokhorov, was Ekaterina Ignatova, the wife of the head of Rostec Sergei Chemezov.

Another shareholder of TCB in 2018 was Sharafiddin Kamaritdinov, the owner of a 1-person "dummy" firm Centralia LLC. Kamaritdinov is likely a nominee who may be backed by Uzbek authorities. The shareholder is an Uzbek citizen but resides in Moscow.

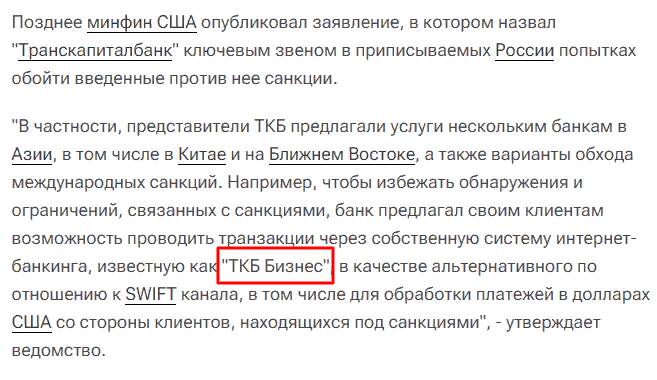

By 2022, TKB was sanctioned for evading sanctions. By that time, the bank’s international operations had reached unprecedented proportions. At the beginning of that year, all banks in Tajikistan, Kyrgyzstan, Mongolia, 80% of the banking systems of Uzbekistan and the Transcaucasian republics, and 60% of banks in Kazakhstan had accounts with TKB.

Before the introduction of sanctions, TKB registered a new payment system, Hello Pay, with the Central Bank. Its founder is Lodgegate Management and Sales LLC, which is now owned and managed by Yuriy Gusev. The company has two subsidiaries: Waybank JSC, acquired in September 2023, and Hello LLC, through which money can be withdrawn. The company’s loss in 2022 amounted to 14 million rubles, in 2023 - 20 million rubles. Judging by the website, the payment system is operational, transfers can be made to 14 countries.

It seems that a real financial shithole is being created in Uzbekistan from Russian and Uzbek companies, which will play the role of a grandiose "laundromat", protected by the authorities on both sides. With such support, any sanctions can be bypassed. In Russia, Uzbekistan and China, law enforcement agencies are controlled by the state. Therefore, no one really thinks about their own image. When it comes to big money, reputation fades into the background.

Read more similar news:

Comments:

comments powered by Disqus