Unlike Americans, Europeans don’t take risks.

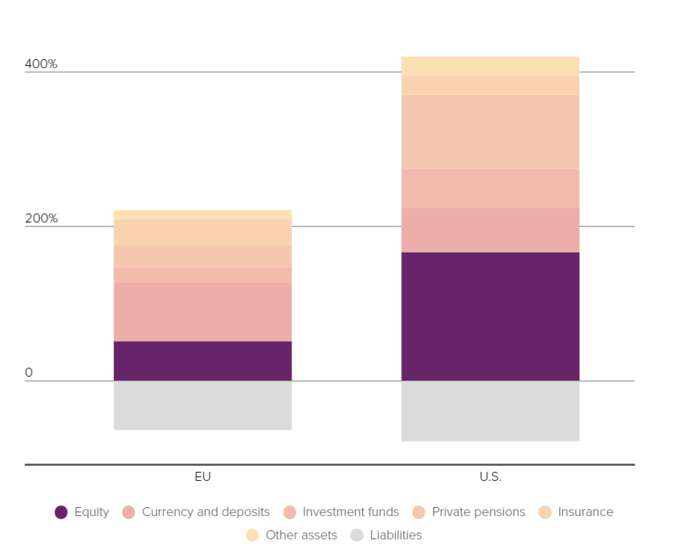

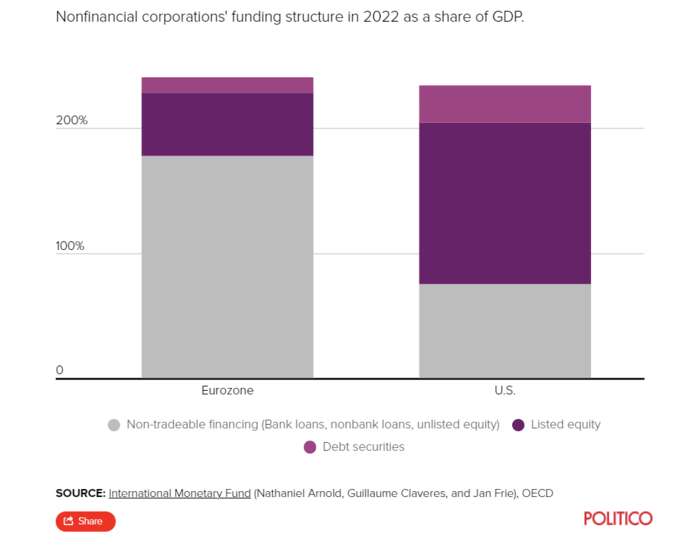

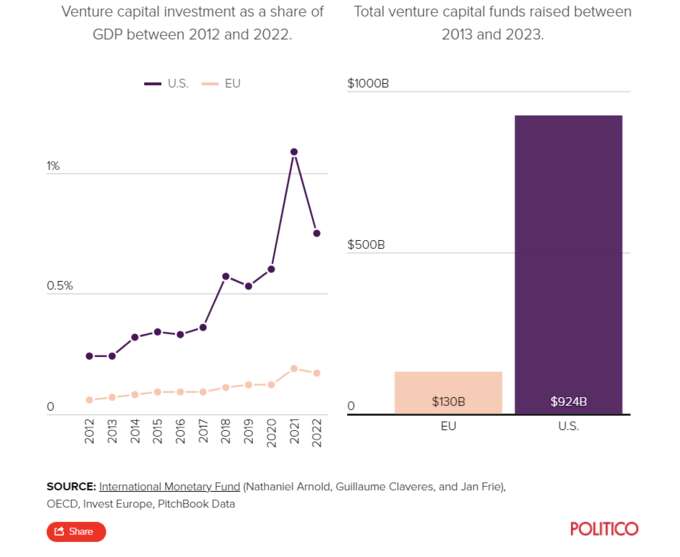

If they did, the €10 trillion they have languishing in their bank accounts ― that’s more than a third the size of the U.S. economy ― could be invested in the stock market instead. That would give companies more cash. That would enable those companies to spend on projects for the public good. And all of that would boost Europe’s drowning economy.

For governments, breaking down barriers to enable all that to happen might be the last chance to save the Continent from slipping into the financial abyss. It’s part of what the European Union calls the capital markets union ― a boring name for a complicated project containing some pretty impenetrable ideas ― but which could be a game changer.